Secure, Governed Data Operations for FinTech

Transform Your Data Infrastructure While Managing Risk

Data Quality Assurance

Automated Risk Controls

End-to-End Data Lineage

Proactive Risk Management

Data Quality Protection

As a Risk Manager at a lending platform,

I want to automatically validate data quality before it enters our credit scoring models,

So that we prevent incorrect loan approvals from corrupted or incomplete data.

- Real-time quality score monitoring

- Automated pipeline protection

- Customizable quality thresholds

- Prevent propagation of compromised data

Model Risk Management

As a Model Risk Manager for a trading platform,

I want to trace the complete lineage of any model prediction,

So that I can quickly demonstrate compliance during regulatory audits.

- Automatic model drift detection

- Performance degradation alerts

- Complete prediction lineage

- Risk-based SLA monitoring

Pipeline Protection

As a Data Operations Manager at a payment processor,

I want automated pipeline health checks with self-healing capabilities, so that our fraud detection systems maintain 99.9% uptime.

- Automated recovery procedures

- Early warning system

- Health check automation

- Impact assessment tools

Comprehensive Data Governance

Immutable Data Architecture

Transform your data governance with our snapshot-based architecture:

- Complete audit trails of all transformations

- Point-in-time reconstruction capability

- Automated lineage tracking

- Historical state preservation

Intelligent Data Protection

As a Data Privacy Officer for a digital bank,

I want automated PII detection across all data repositories,

So that I can prevent unauthorized exposure of sensitive customer information.

- AI-powered PII detection

- Repository-level access controls

- Automated compliance reporting

- Policy violation alerts

Custom Retention Management

- Configurable retention policies

- Automated data lifecycle management

- Selective PII data removal

- Version-aware cleanup

Real-World Applications

Transaction Monitoring

As a Risk Manager at a lending platform,

I want to automatically validate data quality before it enters our credit scoring models,

So that we prevent incorrect loan approvals from corrupted or incomplete data.

- Real-time quality score monitoring

- Automated pipeline protection

- Customizable quality thresholds

- Prevent propagation of compromised data

Model Risk Management

As a Model Risk Manager for a trading platform,

I want to trace the complete lineage of any model prediction,

So that I can quickly demonstrate compliance during regulatory audits.

- Automatic model drift detection

- Performance degradation alerts

- Complete prediction lineage

- Risk-based SLA monitoring

Pipeline Protection

As a Data Operations Manager at a payment processor,

I want automated pipeline health checks with self-healing capabilities, so that our fraud detection systems maintain 99.9% uptime.

- Automated recovery procedures

- Early warning system

- Health check automation

- Impact assessment tools

Measurable Impact

Risk Reduction

- 100% data lineage coverage

- Automated quality controls

- Real-time risk alerts

Operational Efficiency

- 70% reduced manual checks

- Automated compliance reporting

- Self-healing pipelines

Pipeline Protection

- Consolidated tooling

- Reduced engineering overhead

- Automated monitoring

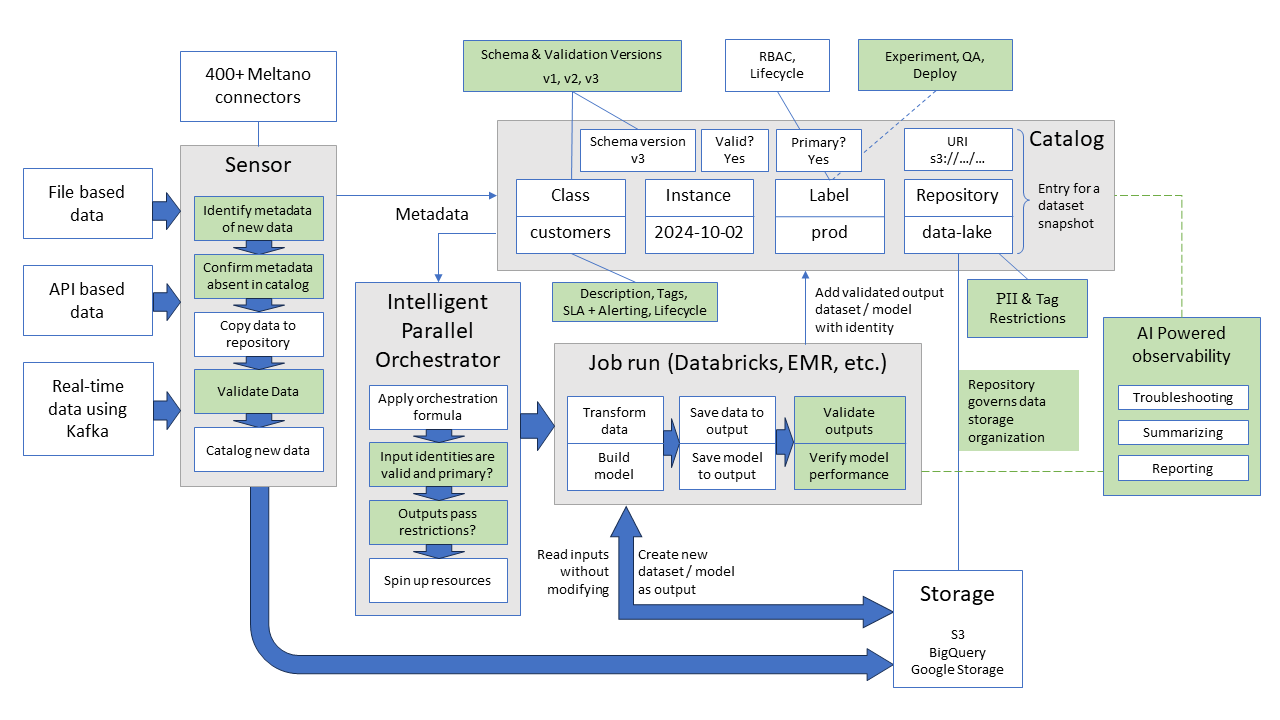

Trel Technical Architecture

Security Capabilities

SSO integration

Granular RBAC controls

Complete audit logging

Supporting Your Compliance Journey

Trel provides robust technical capabilities that strengthen your compliance programs:

Data Protection

As a Compliance Officer, I want automated enforcement of data governance policies,

So that we maintain continuous compliance with regulatory requirements.

- Automated PII detection

- Repository-level controls

- Custom retention policies

- Role-Based Access Control

Audit Readiness

- Complete data lineage

- Quality certification

- Transaction tracing

- Historical reconstruction

Risk Controls

- Quality thresholds

- Pipeline protection

- Model monitoring

- SLA management

Ready to Transform Your Data Operations?

Start with a risk-free technical evaluation